These ideas may well not technically develop passive income, but among the finest strategies to make money is to not commit the money you've got.

Hazard: You’re over the hook to produce your individual investments on several crowdfunding platforms. So when past returns may perhaps seem superior, they’re no predictor of potential good results.

The information here is for basic informational reasons only and should not be deemed an individualized recommendation or personalized investment advice.

Chance: Because the income from your stocks isn’t connected with any activity other than the First financial investment, owning dividend-yielding shares is often Just about the most passive sorts of creating money. The money will just be deposited within your brokerage account.

Fidelity isn't going to provide legal or tax advice. The knowledge herein is general and educational in nature and shouldn't be thought of lawful or tax advice. Tax legislation and polices are sophisticated and matter to alter, which may materially effect investment effects. Fidelity cannot promise that the data herein is precise, full, or timely.

Here are some differing types of investments that pay back dividends, which often can develop a passive income stream.

And whilst it’s a passive activity, you could lose a great deal of money if you don’t know very well what you’re carrying out. Like all inventory, the worth can fluctuate lots within the short term.

New investors should want to stick with publicly traded REITs, which you should buy by means of an online broker. You may also diversify your real estate holdings by buying mutual resources or ETFs that track several REITs.

Housing investment trusts. REITs absolutely are a way to speculate in real estate property without needing to set in all the effort that comes with taking care of Qualities. REITs ordinarily shell out out the majority of their income in dividends, producing them an attractive option for traders in search of passive income.

Developing and sticking to some spending plan is definitely the cornerstone of powerful money management. Start out by monitoring all resources of income and categorizing bills into fixed and variable expenditures.

And whilst an e-guide is nice, it might help for those who generate a lot more and afterwards even Construct here a business round the reserve or make the book only one Component of your enterprise that strengthens the other components. So your biggest possibility is probably that you just squander your time and efforts with minor reward.

The favored perception is that saving money is definitely the ‘Secure’ choice and investing is the risky a single. That’s true to an extent. But when you Think about inflation, you realise that plenty of savings actually eliminate worth or continue to be static with time, given that they just can’t sustain.

Money can provide you with additional passive investment chances. Should you have money to take a position in a very passive chance, you have got not only the opportunity set earlier mentioned but a fresh array, too. Money is often a prerequisite for Making the most of the following passive income areas:

In our Evaluation, these brokerage accounts get noticed as the very best selections for stock investing, because of their minimal costs, sturdy platforms and good quality buyer assist.

Mara Wilson Then & Now!

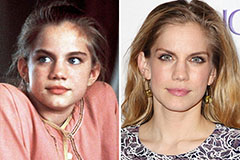

Mara Wilson Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Gia Lopez Then & Now!

Gia Lopez Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!